We are the premier provider of reports about activity on the Hex network and cryptocurrencies and projects supported by the Hex community.

Hex Is Easier Than Rocket Science:

Learn How Hex And Certificates Of Deposit On The

Hex Network Work

Hex: maybe you have heard about it but need help understanding what it is. Well, you have come to the right place. Hex is a smart contract. A smart contract is a computer program that takes information/inputs from different sources and combines it with a set of rules to produce a given output, if certain conditions are met. For example, you may have a smart contract that says, “If the high temperature in New York City reaches 100 degrees Fahrenheit on the 4th of July of this year, according to the National Weather Service, then every New York City resident with an e-mail address will be sent an email from the City of New York with a picture of a smiley face.”

In this case, the information received as input by the City of New York is the temperature reading for the 4th of July published by the National Weather Service. In order for the smart contract to be active, a computer linked to the internet is required, which would receive the temperature reading and then send the smiley face via e-mail to New York City residents, only if the high temperature reaches 100 degrees Fahrenheit on the 4th of July.

In the case of a Hex smart contract, the rules are simple. When a user buys a Hex smart contract, the user could hold on to the contract without doing anything with it (this is called “liquid Hex”). Only liquid Hex can be bought or sold on cryptocurrency exchanges. As a second alternative, the user could activate the smart contract (this is called “staked Hex”). Hex operates on the Ethereum network, and regardless of whether the Hex smart contract is active or not, all Hex is stored on the Ethereum network. When a user activates the Hex smart contract, the Ethereum network records that the contract is active (this is what it means when we say that a Hex stake has been “opened” or that a Hex certificate of deposit has been “issued”). The Ethereum network acts like a decentralized computer, which also stores data. In the case of Hex, the Ethereum network stores all the rules associated with the Hex smart contract, and it employs its computing power to validate the contracts and fulfill the instructions of the contract when the contract conditions are met. Many people also think of Hex as a cryptocurrency, and it is, in the sense that Hex smart contracts are purchased and sold on cryptocurrency exchanges in the same way that Bitcoin or other major cryptocurrencies may be purchased or sold on cryptocurrency exchanges. In addition, the cryptocurrency exchanges list the prices of Hex, just like the prices of other major cryptocurrencies.

What are the contract rules that are being activated in a Hex smart contract? The rules are as follows:

- In exchange for making a commitment to hold the Hex smart contract without forwarding it or selling it to anyone else (this is called the “lock-up” period or “term” of the contract), users will be given the right to create additional unique Hex smart contracts with the same set of rules. These additional copies act like “interest” that a bank customer would receive from a savings account at the bank. That is, when a bank customer uses $1,000 to open a savings account at the bank, the bank may give the bank customer $25 additional dollars after 1 year (with a unique serial number printed on each dollar), which equates to an annual interest rate of 2.5%. The $1,000 amount is known as the “principal” and, in the case of Hex, the number of Hex smart contracts that the user commits to hold without forwarding or selling them to anyone else could also be called “principal”.

- As the term of the contract increases, the user is given the right to create additional Hex in larger amounts for the same period.

- As the principal increases, the user is given the right to create additional Hex in larger amounts for the same period.

In order to enforce or validate that the Hex remains locked during the term of the contract, instead of locking the Hex in a vault, the Ethereum network destroys the Hex and issues a redemption note (like an “IOU”) to the user called a “t-share” (this is the same as when an individual receives a redemption ticket for their car from the valet parking attendant). At any time, users can break the contract by asking for their Hex back before the term is over. When that happens, depending on what percentage of the term has been completed, the user is penalized and is allowed to mint a smaller amount of Hex than otherwise would be allowed, had the term of the contract been served in full. Refer to this link to learn about how penalties are imposed when a Hex CD is ended prematurely:

We strongly advise all users to serve the entire term of their Hex CD, as there are instances when a user may lose the entire principal of the CD upon ending the CD prematurely.

The daily interest payouts vary based on how many CDs are active on the Hex network. As the share of all Hex that is locked in CDs across the network decreases, the payouts become larger, and the opposite occurs when the share increases. Currently, as of Dec 26, 2021 about 9.645% of all Hex that exists is locked in CDs. When that percentage drops, the payout per t-share increases, and when the percentage increases, the payout per t-share decreases. That percentage is referred to as “Staked Supply.” Refer to hexdailystats.com, which offers daily updates on the staked supply, along with other Hex network metrics.

When the term of the Hex CD is over, the t-shares are destroyed and the Ethereum network, as specified by the rules of the Hex contract, gives the user the permission to recreate (mint) the principal plus the additional Hex (the interest).

For a quick guide on how to buy, store and stake your Hex, refer to this link:

https://hex.com/buyandstake/#more

FOR GREATER DETAIL…

The most widely used application to store Hex is the Metamask cryptocurrency wallet. This wallet may be installed on a Chrome or Firefox browser as a browser plug-in or as an app on Android or Apple products. Refer to this link to learn about the Metamask wallet:

In order to move Hex out of the Metamask wallet, the Metamask wallet charges a fee, which is what the Ethereum network requires in order to transact on the Ethereum network. The fees are called “gas fees.” Gas fees (referred to as “Gwei”) are priced in fractions of an Ethereum cryptocurrency. As of December 27, 2021, it took about 620 Gwei to equate to 1 Ethereum. In addition, anytime a user opens a Hex CD or ends a Hex CD, the Metamask wallet will also charge a gas fee because those events are interactions with the Ethereum network. Due to the gas fees required by the Ethereum network, when a user purchases Hex, the user must have enough Ethereum to pay for the fees to transfer the Hex and/or open or end a Hex CD. Typically, the periods when users can find the lowest Ethereum fees are early Sunday mornings, between 5:00AM and 8:00AM ET. Metamask transactions are not instantaneous. They could take several minutes. However, users may speed up their transactions on the Metamask wallet by increasing the fees they are willing to pay. The Metamask wallet offers this option when the transaction is submitted.

Refer to this link for an estimate of gas fees at any given time:

https://etherscan.io/gastracker

Some of the most popular cryptocurrency exchanges used to buy and sell Hex are:

1) Uniswap : https://app.uniswap.org/#/swap

2) Matcha: https://matcha.xyz/

3) 1inch : https://app.1inch.io/#/1/swap/ETH/HEX

When visiting any of these exchange websites, users are asked to give permission to connect their Metamask wallet to the exchange’s website. This allows the exchange to know whether there are any funds/cryptocurrencies available within the Metamask wallet to trade on that exchange. Each exchange website has its own rules regarding fees, which we strongly advise users to read. Every time a user executes a purchase or sell order, the exchange website will inform users of the amount of gas fees required to perform the transaction. Remember, gas fees are always paid with Ethereum cryptocurrency. Once users are informed of the gas fee, they will be given the opportunity to accept or decline the transaction before they are charged the fee. If the user does not have enough Ethereum to pay for the gas fee, then the transaction will not be accepted.

The most common cryptocurrencies used to buy Hex are USDC and Ethereum. These cryptocurrencies may be purchased on a variety of cryptocurrency exchanges. We recommend the Coinbase exchange, where users can buy Ethereum and USDC with US dollars and other cryptocurrencies.

Link To Coinbase: https://www.coinbase.com/join/jmarti

Remember, all fees required to transact on the Ethereum network and Metamask wallet are paid with Ethereum, but the Hex itself may be purchased with USDC, Ethereum or any other cryptocurrency that is available to trade on Uniswap, Matcha or 1inch exchange.

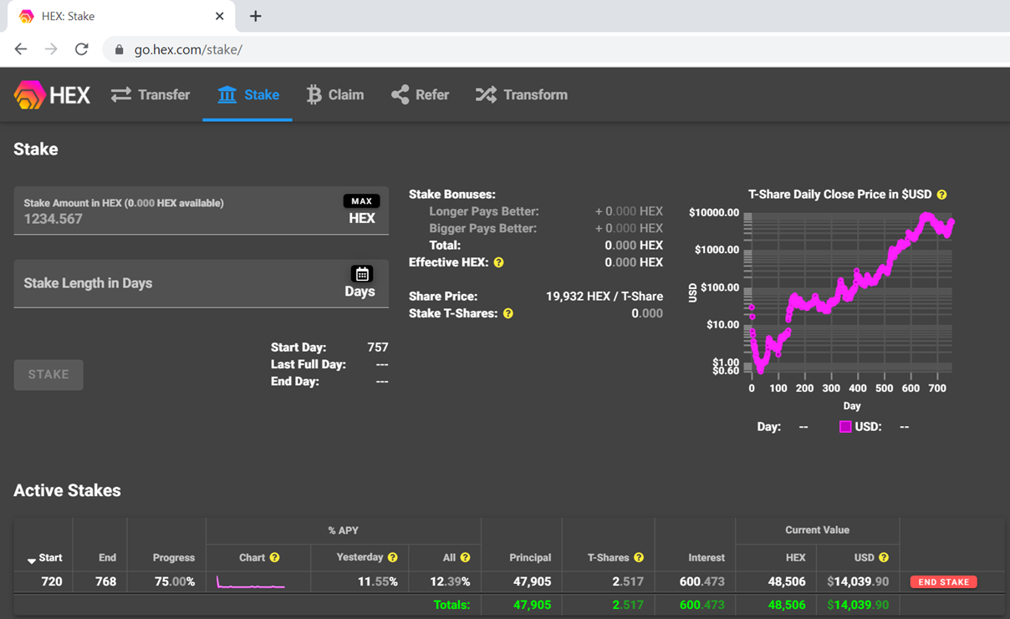

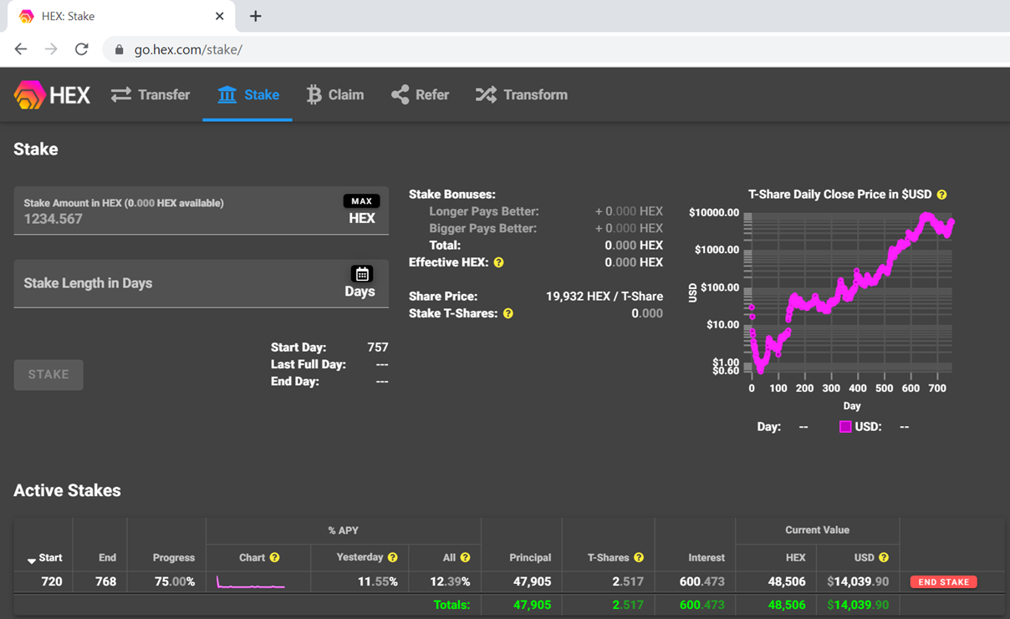

Once Hex is purchased and stored in the Metamask wallet, users may visit go.hex.com and connect their Metamask wallet to the website to open a Hex CD. To do so, users go to the menu and select “Stake.” Remember, a “stake” is another name for a “certificate of deposit (CD).” On that page, users specify the terms of the CD by entering the amount of Hex that they wish to lock (the principal) and the number of days that they wish to lock it up for (the term). Then, after pressing the “STAKE” button located just below where the “stake length in days” is entered, the CD will become active starting at 12:00AM UTC. The “start” column reflects the day that the CD started. (The number in the “start” column also represents how many days the Hex network has been operating.) In the example below, the CD started on day 720 and will end on day 768.

When the term of the CD has been served in full, the “Progress” column will indicate 100%. At that time, the “End Stake” button may be pressed without incurring any penalties. After pressing the “End Stake” button, the Hex balances on the Metamask wallet will increase to reflect the amount of Hex released from the CD. If the “End Stake” button is not pressed, the CDs value will be reduced after 14 days, by 0.143% per day (or 1% per week).

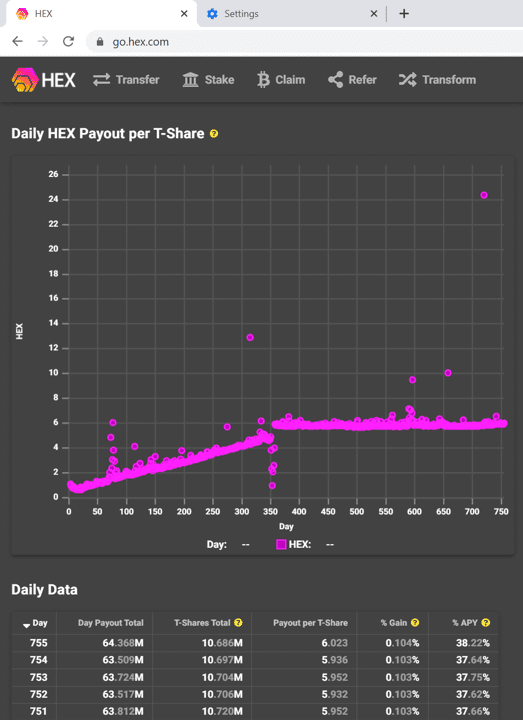

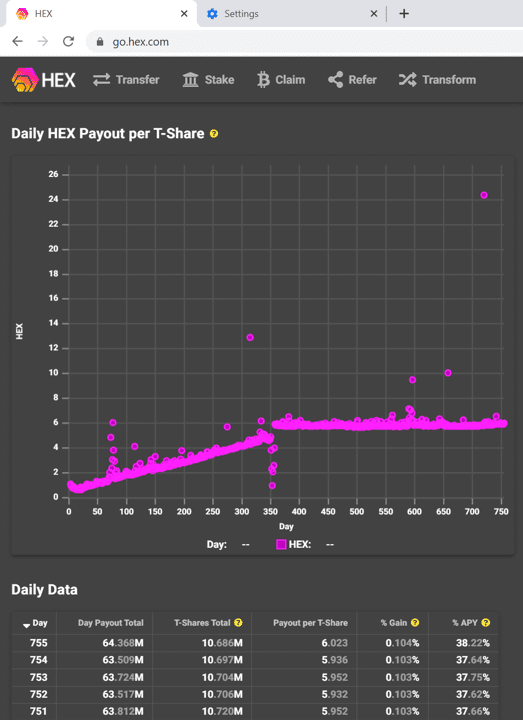

The column labeled “T-Shares” indicates how many t-shares were assigned to the CD. The amount of Hex earned per day (the interest) depends on the t-shares assigned to the CD. In the example above, 2.517 t-shares were assigned to a CD that was opened with 47,905 Hex, for a period of 48 days. When a user presses the Hex logo, and scrolls down the page, the following Hex payout per T-Share statistics are displayed:

Using the information above, we know how much interest was paid to the CD on each day by multiplying the t-shares assigned to the CD by the payout per t-share on that day. For example, on day 755 the CD above was paid 2.517*6.023 Hex, which equals 15.159891 Hex. Remember that the CDs that get the most t-shares and highest interest rate, are those that are opened for the longest term. The longest term that a Hex CD can be opened for is 5,555 days. It is not unusual to see annualized interest rates above 35% for CDs issued for 10–15-year terms.

Note that this overview is sufficient for the vast majority of Hex users to learn to interact with the Hex smart contract. If you’d like additional details, the developers of Hex have prepared a document that provides further information about the inner workings of Hex. See the link below:

Hex Is Easier Than Rocket Science:

Learn How Hex And Certificates Of Deposit On The

Hex Network Work

Hex: maybe you have heard about it but need help understanding what it is. Well, you have come to the right place. Hex is a smart contract. A smart contract is a computer program that takes information/inputs from different sources and combines it with a set of rules to produce a given output, if certain conditions are met. For example, you may have a smart contract that says, “If the high temperature in New York City reaches 100 degrees Fahrenheit on the 4th of July of this year, according to the National Weather Service, then every New York City resident with an e-mail address will be sent an email from the City of New York with a picture of a smiley face.”

In this case, the information received as input by the City of New York is the temperature reading for the 4th of July published by the National Weather Service. In order for the smart contract to be active, a computer linked to the internet is required, which would receive the temperature reading and then send the smiley face via e-mail to New York City residents, only if the high temperature reaches 100 degrees Fahrenheit on the 4th of July.

In the case of a Hex smart contract, the rules are simple. When a user buys a Hex smart contract, the user could hold on to the contract without doing anything with it (this is called “liquid Hex”). Only liquid Hex can be bought or sold on cryptocurrency exchanges. As a second alternative, the user could activate the smart contract (this is called “staked Hex”). Hex operates on the Ethereum network, and regardless of whether the Hex smart contract is active or not, all Hex is stored on the Ethereum network. When a user activates the Hex smart contract, the Ethereum network records that the contract is active (this is what it means when we say that a Hex stake has been “opened” or that a Hex certificate of deposit has been “issued”). The Ethereum network acts like a decentralized computer, which also stores data. In the case of Hex, the Ethereum network stores all the rules associated with the Hex smart contract, and it employs its computing power to validate the contracts and fulfill the instructions of the contract when the contract conditions are met. Many people also think of Hex as a cryptocurrency, and it is, in the sense that Hex smart contracts are purchased and sold on cryptocurrency exchanges in the same way that Bitcoin or other major cryptocurrencies may be purchased or sold on cryptocurrency exchanges. In addition, the cryptocurrency exchanges list the prices of Hex, just like the prices of other major cryptocurrencies.

What are the contract rules that are being activated in a Hex smart contract? The rules are as follows:

- In exchange for making a commitment to hold the Hex smart contract without forwarding it or selling it to anyone else (this is called the “lock-up” period or “term” of the contract), users will be given the right to create additional unique Hex smart contracts with the same set of rules. These additional copies act like “interest” that a bank customer would receive from a savings account at the bank. That is, when a bank customer uses $1,000 to open a savings account at the bank, the bank may give the bank customer $25 additional dollars after 1 year (with a unique serial number printed on each dollar), which equates to an annual interest rate of 2.5%. The $1,000 amount is known as the “principal” and, in the case of Hex, the number of Hex smart contracts that the user commits to hold without forwarding or selling them to anyone else could also be called “principal”.

- As the term of the contract increases, the user is given the right to create additional Hex in larger amounts for the same period.

- As the principal increases, the user is given the right to create additional Hex in larger amounts for the same period.

In order to enforce or validate that the Hex remains locked during the term of the contract, instead of locking the Hex in a vault, the Ethereum network destroys the Hex and issues a redemption note (like an “IOU”) to the user called a “t-share” (this is the same as when an individual receives a redemption ticket for their car from the valet parking attendant). At any time, users can break the contract by asking for their Hex back before the term is over. When that happens, depending on what percentage of the term has been completed, the user is penalized and is allowed to mint a smaller amount of Hex than otherwise would be allowed, had the term of the contract been served in full. Refer to this link to learn about how penalties are imposed when a Hex CD is ended prematurely:

We strongly advise all users to serve the entire term of their Hex CD, as there are instances when a user may lose the entire principal of the CD upon ending the CD prematurely.

The daily interest payouts vary based on how many CDs are active on the Hex network. As the share of all Hex that is locked in CDs across the network decreases, the payouts become larger, and the opposite occurs when the share increases. Currently, as of Dec 26, 2021 about 9.645% of all Hex that exists is locked in CDs. When that percentage drops, the payout per t-share increases, and when the percentage increases, the payout per t-share decreases. That percentage is referred to as “Staked Supply.” Refer to hexdailystats.com, which offers daily updates on the staked supply, along with other Hex network metrics.

When the term of the Hex CD is over, the t-shares are destroyed and the Ethereum network, as specified by the rules of the Hex contract, gives the user the permission to recreate (mint) the principal plus the additional Hex (the interest).

For a quick guide on how to buy, store and stake your Hex, refer to this link:

https://hex.com/buyandstake/#more

FOR GREATER DETAIL…

The most widely used application to store Hex is the Metamask cryptocurrency wallet. This wallet may be installed on a Chrome or Firefox browser as a browser plug-in or as an app on Android or Apple products. Refer to this link to learn about the Metamask wallet:

In order to move Hex out of the Metamask wallet, the Metamask wallet charges a fee, which is what the Ethereum network requires in order to transact on the Ethereum network. The fees are called “gas fees.” Gas fees (referred to as “Gwei”) are priced in fractions of an Ethereum cryptocurrency. As of December 27, 2021, it took about 620 Gwei to equate to 1 Ethereum. In addition, anytime a user opens a Hex CD or ends a Hex CD, the Metamask wallet will also charge a gas fee because those events are interactions with the Ethereum network. Due to the gas fees required by the Ethereum network, when a user purchases Hex, the user must have enough Ethereum to pay for the fees to transfer the Hex and/or open or end a Hex CD. Typically, the periods when users can find the lowest Ethereum fees are early Sunday mornings, between 5:00AM and 8:00AM ET. Metamask transactions are not instantaneous. They could take several minutes. However, users may speed up their transactions on the Metamask wallet by increasing the fees they are willing to pay. The Metamask wallet offers this option when the transaction is submitted.

Refer to this link for an estimate of gas fees at any given time:

https://etherscan.io/gastracker

Some of the most popular cryptocurrency exchanges used to buy and sell Hex are:

1) Uniswap : https://app.uniswap.org/#/swap

2) Matcha: https://matcha.xyz/

3) 1inch : https://app.1inch.io/#/1/swap/ETH/HEX

When visiting any of these exchange websites, users are asked to give permission to connect their Metamask wallet to the exchange’s website. This allows the exchange to know whether there are any funds/cryptocurrencies available within the Metamask wallet to trade on that exchange. Each exchange website has its own rules regarding fees, which we strongly advise users to read. Every time a user executes a purchase or sell order, the exchange website will inform users of the amount of gas fees required to perform the transaction. Remember, gas fees are always paid with Ethereum cryptocurrency. Once users are informed of the gas fee, they will be given the opportunity to accept or decline the transaction before they are charged the fee. If the user does not have enough Ethereum to pay for the gas fee, then the transaction will not be accepted.

The most common cryptocurrencies used to buy Hex are USDC and Ethereum. These cryptocurrencies may be purchased on a variety of cryptocurrency exchanges. We recommend the Coinbase exchange, where users can buy Ethereum and USDC with US dollars and other cryptocurrencies.

Link To Coinbase: https://www.coinbase.com/join/jmarti

Remember, all fees required to transact on the Ethereum network and Metamask wallet are paid with Ethereum, but the Hex itself may be purchased with USDC, Ethereum or any other cryptocurrency that is available to trade on Uniswap, Matcha or 1inch exchange.

Once Hex is purchased and stored in the Metamask wallet, users may visit go.hex.com and connect their Metamask wallet to the website to open a Hex CD. To do so, users go to the menu and select “Stake.” Remember, a “stake” is another name for a “certificate of deposit (CD).” On that page, users specify the terms of the CD by entering the amount of Hex that they wish to lock (the principal) and the number of days that they wish to lock it up for (the term). Then, after pressing the “STAKE” button located just below where the “stake length in days” is entered, the CD will become active starting at 12:00AM UTC. The “start” column reflects the day that the CD started. (The number in the “start” column also represents how many days the Hex network has been operating.) In the example below, the CD started on day 720 and will end on day 768.

When the term of the CD has been served in full, the “Progress” column will indicate 100%. At that time, the “End Stake” button may be pressed without incurring any penalties. After pressing the “End Stake” button, the Hex balances on the Metamask wallet will increase to reflect the amount of Hex released from the CD. If the “End Stake” button is not pressed, the CDs value will be reduced after 14 days, by 0.143% per day (or 1% per week).

The column labeled “T-Shares” indicates how many t-shares were assigned to the CD. The amount of Hex earned per day (the interest) depends on the t-shares assigned to the CD. In the example above, 2.517 t-shares were assigned to a CD that was opened with 47,905 Hex, for a period of 48 days. When a user presses the Hex logo, and scrolls down the page, the following Hex payout per T-Share statistics are displayed:

Using the information above, we know how much interest was paid to the CD on each day by multiplying the t-shares assigned to the CD by the payout per t-share on that day. For example, on day 755 the CD above was paid 2.517*6.023 Hex, which equals 15.159891 Hex. Remember that the CDs that get the most t-shares and highest interest rate, are those that are opened for the longest term. The longest term that a Hex CD can be opened for is 5,555 days. It is not unusual to see annualized interest rates above 35% for CDs issued for 10–15-year terms.

Note that this overview is sufficient for the vast majority of Hex users to learn to interact with the Hex smart contract. If you’d like additional details, the developers of Hex have prepared a document that provides further information about the inner workings of Hex. See the link below:

THE HEX NETWORK

Spotlight

Find Our reports on our

twitter and reddit Pages

If you find value in our work, please consider making a donation in the form of any of the following cryptocurrencies:

HEX, USDC, Pulse, PulseX, PulseDogecoin, Ethereum, Hedron, Maxi

Please use this address for your donation: